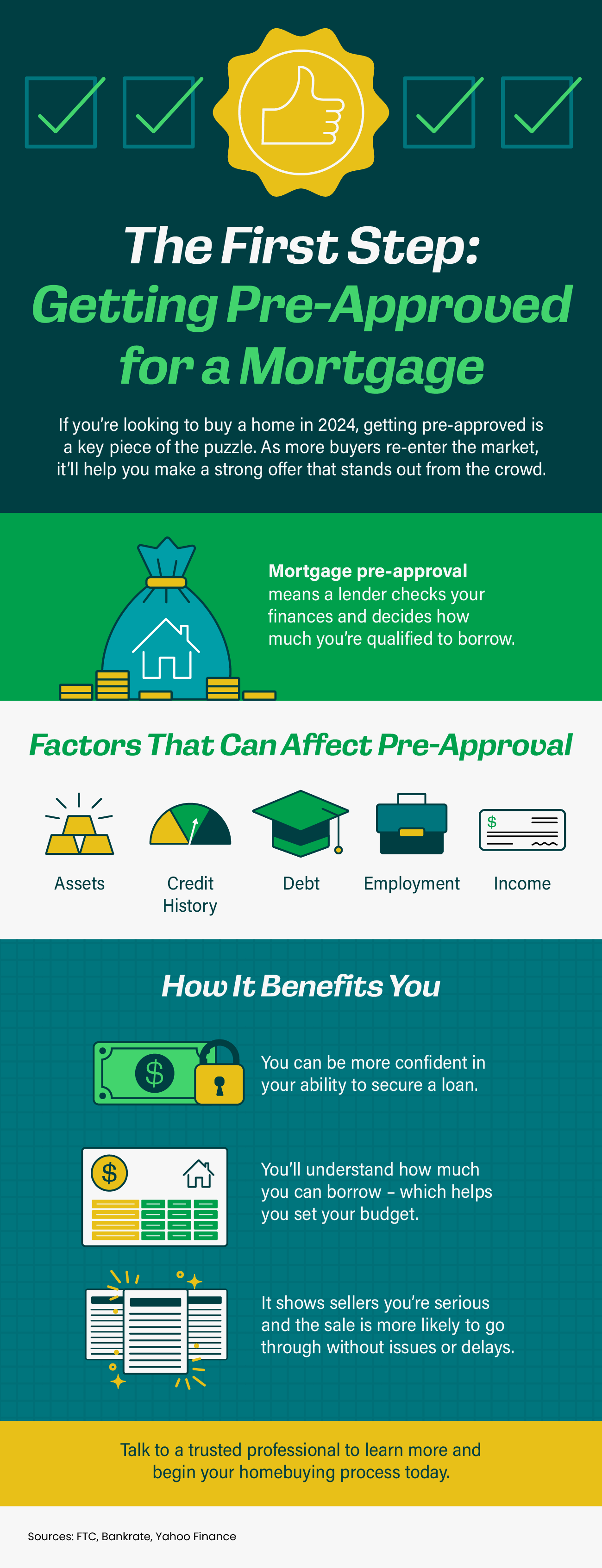

The First Step: Getting Pre-Approved for a Mortgage

Some Highlights

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

- All Blogs (347)

- Buyers (160)

- Condos (2)

- Economy (1)

- Equity (4)

- Events (3)

- Featured Home (2)

- First-Time Home Buyer (69)

- For Sale By Owner (1)

- Foreclosures (3)

- Get A Life Pet Rescue (1)

- Informative (38)

- Luxury (2)

- Market Insight (75)

- Mortgage Rates (9)

- Renters (6)

- renting (3)

- Sellers (128)

- VA Loans (2)

- video (1)

Recent Posts

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Is a Fixer Upper Right for You?

How Real Estate Agents Take the Fear Out of Moving

Avoid These Top Homebuyer Mistakes in Today’s Market

Why Home Sales Bounce Back After Presidential Elections

Why Your House Will Shine in Today’s Market

Why Today’s Foreclosure Numbers Won’t Trigger a Crash

Planning To Sell Your House in 2025? Start Prepping Now

What To Expect from Mortgage Rates and Home Prices in 2025

Why Did More People Decide To Sell Their Homes Recently?

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "