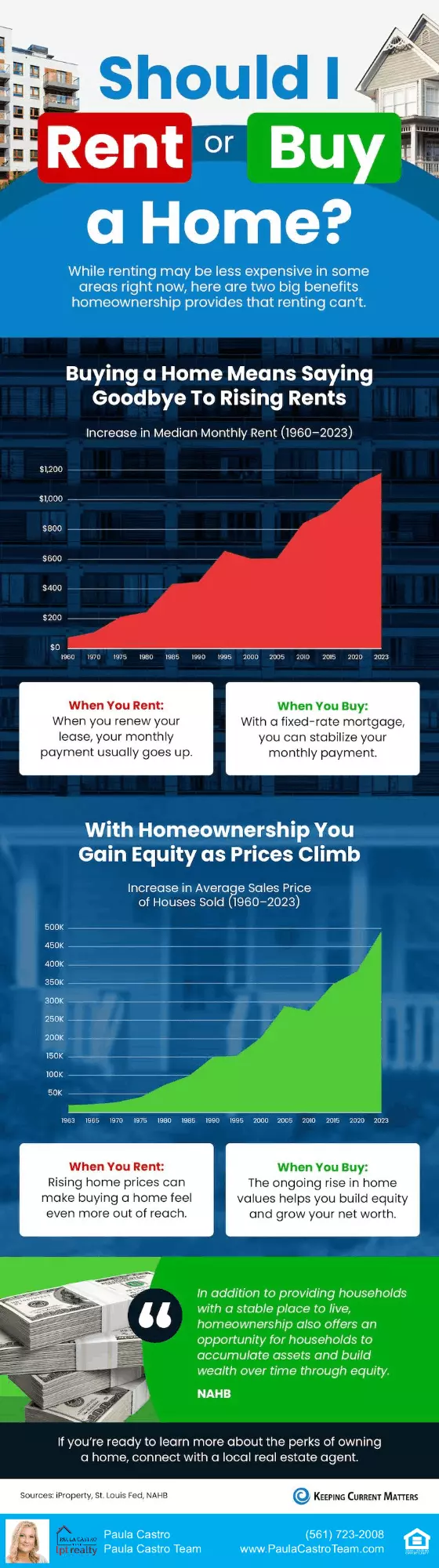

Should I rent or buy

Homeowner Net Worth Has Skyrocketed

If you’re weighing your options to decide whether it makes more sense to rent or buy a home today, here’s one key data point that could help you feel more confident in making your decision. Every three years, the Federal Reserve Board releases the Survey of Consumer Finances (SCF). That report cover

Renting or Selling Your House: What's the Best Move?

If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they’re an investment that’s gained popularity in recent years. While

Categories

- All Blogs (347)

- Buyers (160)

- Condos (2)

- Economy (1)

- Equity (4)

- Events (3)

- Featured Home (2)

- First-Time Home Buyer (69)

- For Sale By Owner (1)

- Foreclosures (3)

- Get A Life Pet Rescue (1)

- Informative (38)

- Luxury (2)

- Market Insight (75)

- Mortgage Rates (9)

- Renters (6)

- renting (3)

- Sellers (128)

- VA Loans (2)

- video (1)

Recent Posts

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Is a Fixer Upper Right for You?

How Real Estate Agents Take the Fear Out of Moving

Avoid These Top Homebuyer Mistakes in Today’s Market

Why Home Sales Bounce Back After Presidential Elections

Why Your House Will Shine in Today’s Market

Why Today’s Foreclosure Numbers Won’t Trigger a Crash

Planning To Sell Your House in 2025? Start Prepping Now

What To Expect from Mortgage Rates and Home Prices in 2025

Why Did More People Decide To Sell Their Homes Recently?